Investors saw lots of volatility in this morning’s pre-market, with front-month natural gas rising almost 34% week over week. How is it possible that one of the world’s most liquid and used commodities can experience a swing from 4.7 to 6.3? There is an energy crisis going on in many parts of the world, sending commodities such as oil and gas higher.

Nasdaq was down 1.4% premarket, giving back all the gains in the past week. VIX is back over 20, but still far below the highs last Monday when VIX almost touched 30 following China Evergrande contagion fears. Bonds continue their relentless slide, signaling interest rates may rise even sooner.

Inflation Coming? Why Does Energy Matter?

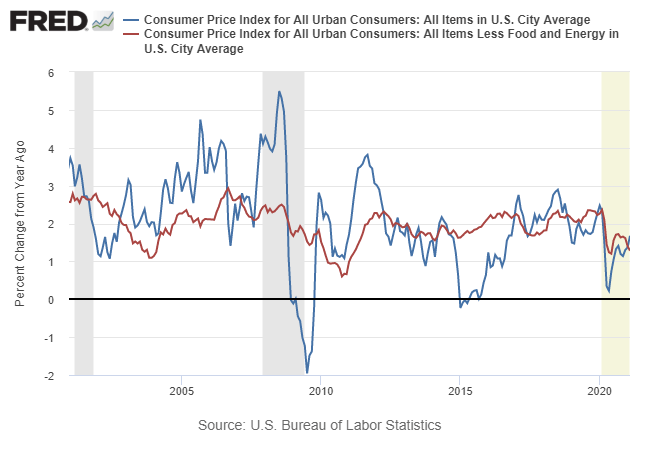

Why does that matter to real estate investors? Traditionally, energy prices have been one of the key components in measuring inflation. Economists measure prices over time by tracking a basket of goods and services, such as food, shelter, transportation, and energy. One common criticism is that the Consumer Price Index does not measure what economists call the substitution effect. If the price of beef goes up a lot, then perhaps people will consume less beef and instead substitute more chicken, pork, or tofu. Therefore, any index such as CPI will suffer from the percentage weight of any one item staying relatively fixed.

How about energy, is that a more reliable source of tracking inflation? No matter what happens, most of us only have one electric company we can choose, and everyone in the same neighborhood should be paying pretty much the same fair price. Unfortunately, sometimes energy prices get very volatile: we saw it when crude oil prices went negative in April 2020, we are seeing it now in natural gas, and consumers tend to see fluctuations in their monthly energy spending.

So if food and energy prices are sometimes not reliable indicators, is there a solution? It turns out economists consider both the normal CPI, but also at a concept called “Core Inflation”, which is inflation when ignoring food and energy! Under core inflation, shelter such as apartment rentals and home maintenance becomes a bigger component.

Why Does Inflation Matter?

The Federal Reserve controls short-term interest rates, which impacts long-term interest rates. Their actions heavily determine lone-term rates, and therefore mortgage rates on real estate purchases and investments. What’s amazing is the sheer speed that bonds have fallen since the most recent FOMC statement.

Also interesting is the break in correlation between stocks and bonds. Normally, when investors sell stocks during a time of panic, they shift their holdings and flee to the safety of bonds. However, this is a special panic caused by what some see as the end to near-zero interest rates, or forced action from the Fed, or even a possible US debt credit crisis from the political situation surrounding the debt ceiling. In any event, expect more choppiness ahead in the coming weeks, and do not trust historical correlations.

Mr. "Hud" Chavij recently came from abroad and brought with him a level of determination and creativity that instantly gained him a reputation among the NYC real estate thought leaders.