After a summer of only mild downticks and dips, equity and crypto investors woke up Monday September 20th to one of the largest weekend sell-offs of 2021. However, in context, Nasdaq and S&P levels are still only 5% below the all-time highs from 3 weeks ago. Bitcoin is still well almost 50% above the post-Elon Musk rejection scare of 29000. Still, something feels a little more real this time.

What happened this weekend, and the past two weeks? What is the Evergrande Group and how did one distant real estate company impact the entire market? Is there more to the crash today than China? More importantly, when can we buy the dip?

Evergrande Group Default Risk

Although most of us have never heard of the Evergrande Group, they are the 2nd largest real estate developer in China. Long story short, they take on lots of leverage and make real estate investments, buying land, constructing new development projects, and managing properties. They own reportedly 1300+ properties spread all over China in almost 300 cities of various sizes.

Anyway, their problems began in the usual way. A lot of leverage, including $130 billion in USD of loads owed to banks everywhere. When they ran low on cash, they offered to pay back investors in real estate instead. Not joking. Instead of getting your interest and principal back, how would like a deeply discounted condo? Or perhaps, shares in the future revenue of some department stores? Supposedly, even the employees of the company were asked to take an IOU on their salaries in order to help shore up the balance sheet. We all know how the story goes from there. It’s a good old fear-driven bank run, whether or not the fear is warranted, it becomes a self-fulfilling prophecy.

Perhaps it is fate that the 2008 financial crisis began with a few over-leveraged lenders and a frenzy of consumers who felt real estate would never topple. It began with the demise of New Century Financial in early 2007. At the time, it seemed like a distant corner of the capital markets, confined only to subprime lending. However, over the next year things spiraled out of control, ultimately leading to the collapse of Bear Stearns, Lehman Brothers, and near-deaths of even AIG and Fannie Mae by September 2008.

Once a few dominos fall, the rest of the system can quickly cascade into an insolvency spiral. Are we doomed to repeat the same contagion effect from over a decade ago? Probably not — but just in case, the fear is there. That fear is enough reason for a lot of players to take some chips off the table.

Stock, Real Estate, and Crypto Valuations in Doubt

Should these debt and liquidity crunch issues have much impact on the wildly successful revenue growth of our US tech favorites? While there should be no immediate impact on Apple, Amazon, and Alphabet revenue growth, there is still what many call an long overdue correction for the entire US stock market. Not only did absolute index levels hit all-time highs in early September, but the S&P has been trading at the historical high end of it’s earnings multiple (almost 30 in aggregate PE ratio).

Somehow, we spent all of 2020 with an average VIX trading between 30 and 40. The past 4 months have seen relatively smooth sailing at levels half of that. Realized volatility was also extremely low to the downside – if there was any tail risk, it was the unexpected strength and relentlessness of the rallies.

According to value investors such as Warren Buffett, almost no asset is truly safe at these levels. Cryptos, meme stocks, and unprofitable SPACs have no intrinsic value, but can sustain the price action thanks to a large swath of hopeful investors (who graciously share their secrets with their friends). Even classic mega caps have moved well out of value-stock territory, with $2+ trillion market caps like Microsoft trading at a 37 PE.

Pandemic and Stimulus Ending, Rates Rising?

The other big elephant in the room is a realization that the endless government stimulus will finally come to an end. Employment levels are still over a million jobs below pre-pandemic levels, and many industries have still not returned to anywhere near a sustainable level. The latest congressional debate is about the $3.5 trillion budget package, which involves raising taxes and expanding social safety nets. However, there is nothing on the table to do a 4th round of stimulus checks, or a 3rd PPP draw.

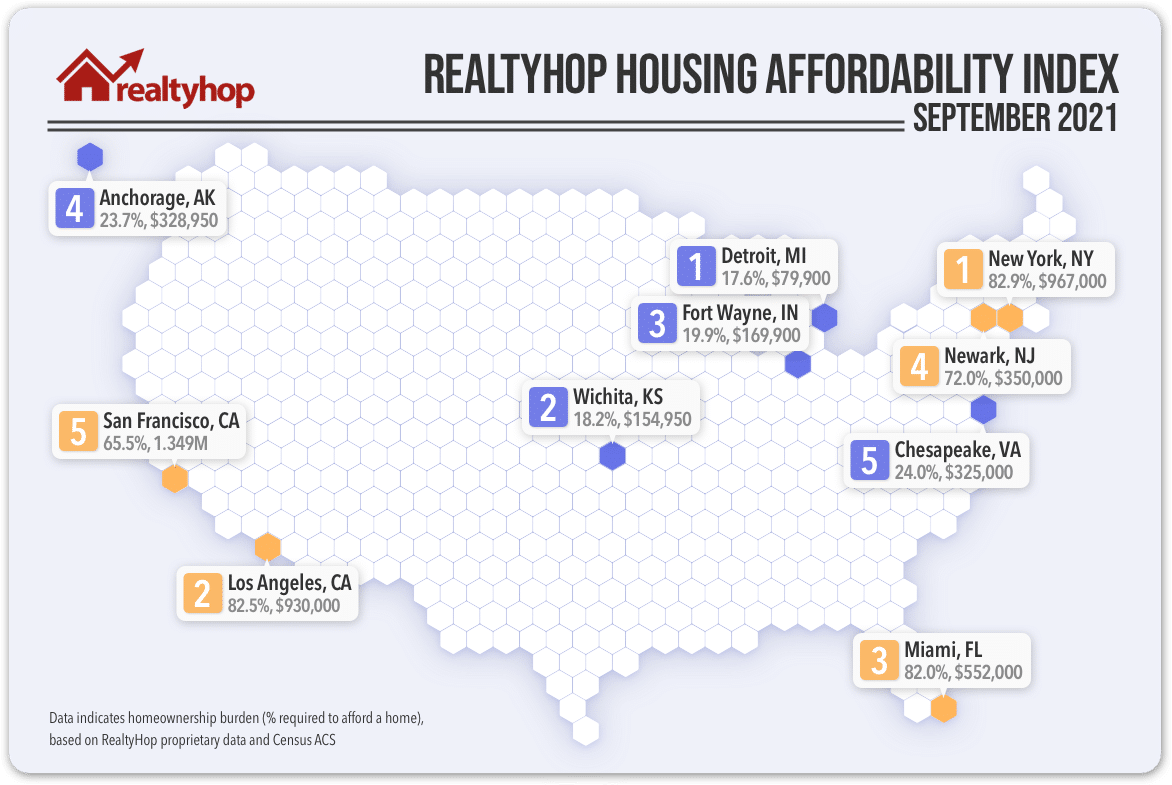

In real estate, cities everywhere all summer long saw shrinking cap rates and huge bidding wars. Many investors have bought ahead of the perceived inevitable rise in mortgage rates, which leads to a decrease in home affordability. The Fed has committed to accommodative monetary policy for as long as necessary. But investors and experts agree – sooner or later, inflation will become a strong enough concern that long and short term rates will rise.

As the cost of capital increases for corporations and home owners, we may see the usual downward pressure on asset prices. Data from RealtyHop shows income has not tracked home ownership costs in most of the major US cities. New York, LA, Miami are now the three least affordable markets (in fact, renting is a bargain at the moment). Even Newark is less affordable that the San Francisco (remember, tech incomes are up a lot). As more families take on large mortgages to purchase their dream homes, the more precarious individual household finances become during a downturn.

Although the market move in the past two weeks could be just another hiccup on the way to new all-time highs, the risks are clearly there. Proceed carefully and conservatively!

Mr. "Hud" Chavij recently came from abroad and brought with him a level of determination and creativity that instantly gained him a reputation among the NYC real estate thought leaders.