After yesterday’s violent 500-point plunge, the Nasdaq pared approximately half of the losses by today’s pre-market on September 21st, 2021. In fact, most of the recovery came in the final 20 minutes of the trading day yesterday, marking what might be the beginning of yet another incredible V-shaped recover. The old “buy-the-dip” mentality is back, a strategy that has worked particularly well since during since the beginning of the Covid-19 pandemic.

Is the selling over for now? Will we see new all-time highs again after Fed chair Powell speaks again? Or is the two-sided action we have seen for most of September the new normal, which choppy markets to come through the remainder of the year? With VIX still in the mid-20s, down from a intraday high of nearly 29, investors are positioning themselves more conservatively for the coming days.

We saw a preview these past few days on exactly which assets are likely to plunge: crypto assets, meme stocks, and speculative recovery stocks (think casinos and airlines). For example, while the Nasdaq was down nearly 2.5% at the bottom, Wall Street Bets favorites such as AMC and GME were down close to 10%.

Not All Asset Correlations Hold

Regardless of where the market goes from here, the shockingly scary peak-to-trough plunge revealed which assets are most at risk during a panic sell. Max Stone, head of macro trading at D. E. Shaw & Co., once said, “During a panic, historical asset correlations no longer apply. All correlations become 1.0 or -1.0”. Quantitative hedge funds such as Two Sigma, Jane Street, and D. E. Shaw carefully calculate the risk factors on each of their positions. Their portfolio management strategy relies heavily on historical covariances between pairs of assets, hoping to hedge away most market risks while waiting to realize model-driven price forecasts.

If all that sounds too mathematical, don’t worry. You don’t need a gold medal in the International Math Olympiad to understand the key takeaway. Even the most rudimentary risk measurements use the historical relationships between asset prices to determine how things behave in future scenarios. MBAs spend entire semesters analyzing companies and their various betas, taking into account its sensitivity to the market, its industry peers, and even the amount of debt and leverage. Options traders carefully balance their greeks, converting most of their positions into their SPY-weighted delta (sensitivity to the S&P).

Does Diversification Work in 2021?

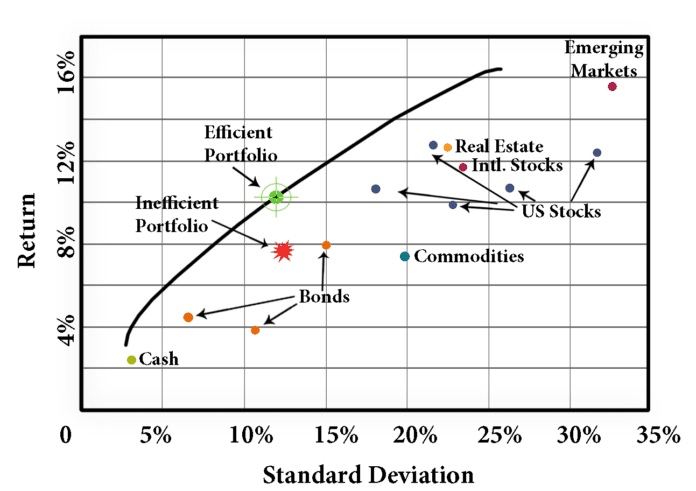

Everyone learns diversification is the only free lunch in investing. Theoretically, if you have two assets that both provide a positive expected return and are not perfectly correlated, then you can construct some mixture of the two that will produce a better risk-reward than each individual asset. For example, holding a basket of stocks might produce a higher return than real estate investing, however holding both stocks and real estate could produce a more optimal result (better sharpe ratio).

Unfortunately, back to Mr. Stone’s wisdom, whatever intricate or crude calculations you might have, they are probably wrong during a time of true stress. A different kind of market mentality dominates, which leaves traders of all sizes fleeing to safety. Although Perhaps the best advice is to “stay small”, as Tasty Trade founder Tom Sosnoff often tells his hundreds of thousands of listeners. Although there is an urge to dive in a make more trades during a time of market dislocation, another quant adage applies: “When market volatility doubles, you should have four times the conviction in your trades.”

Mr. "Hud" Chavij recently came from abroad and brought with him a level of determination and creativity that instantly gained him a reputation among the NYC real estate thought leaders.