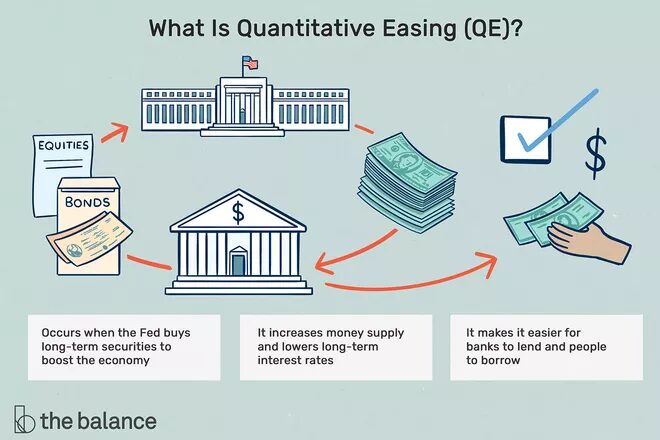

And just like that… Big Tech died. Only 3 days into 2022 and the largest names in technology are down sharply. The Fed minutes released yesterday accelerated our fears that rates would soon rise. Rather than simply taper or reduce the Federal Reserve bond buying program, the documents reveal some members want to actually sell previously purchased bonds on the open market (a reverse quantitative easing, H/T TheBalance).

Those of us who remember the post-2008 crisis will realize the sharp change. Bernanke never felt a need to quickly trim the balance sheet acquired via quantitative easing. He was on record saying they could foresee simply holding all of the assets to maturity, quietly collecting coupons and ultimately the principal at maturity.

Profits Amid Tech Rout

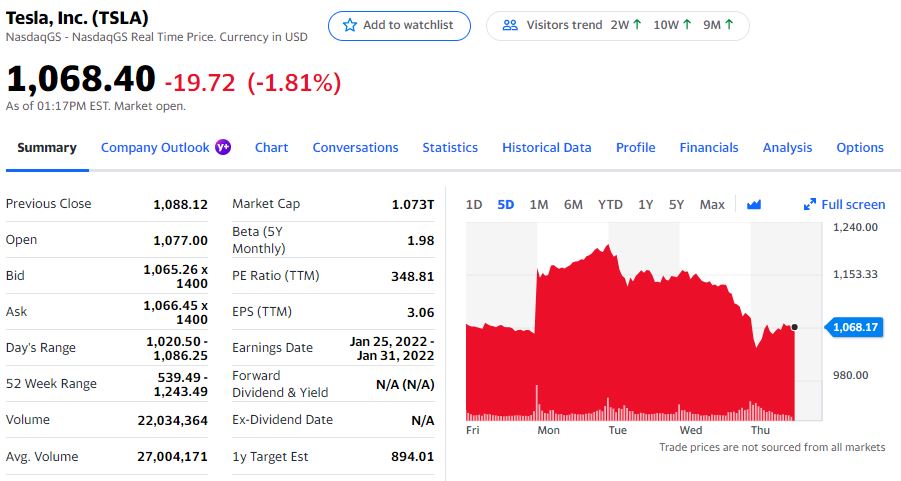

The reaction has been swift. The Nasdaq closed down 500 points following a nearly 300 point drop the day prior. Futures traded yet another 150 points lower during Asia hours. Tesla even gave back all of the January 3rd gains following the release of their annual shipment numbers.

However, options traders are coming up with creative strategies to take advantage of the endless two-sided action. Rather than picking a level to outright short the stock, the RealtyHop quants build in a buffer that allows for more room to rally while capitalizing on the hefty call option premiums. They took profits and closed the TSLA trade only two days later. Still, they are losing money on some other strangle positions, so whether the mortgage prepayment challenge succeeds is very much TBD with 247 or so trading days remaining.

Mr. "Hud" Chavij recently came from abroad and brought with him a level of determination and creativity that instantly gained him a reputation among the NYC real estate thought leaders.