The huge magnitude 7.4 earthquake centered in Taiwan’s Hualien region raises some age-old questions about how to tease apart the value of real property. How much of the value is the land, and how much is the residence built on top of the land? The question comes up over and over again in various contexts: appraisal, property tax assessment, tax depreciation, and with the latest news, insurance.

Insurance Concerns: Taiwan Earthquake Case Study

Why does it matter? When you buy homeowner’s or disaster insurance for your house, you need a policy that covers the cost of rebuilding the damaged building. You do NOT get paid for the entire value of your real estate, because in theory the land can not be damaged by fires, flooding, earthquakes, or other problems that can ordinarily destroy a building. Land is forever finite, and the value comes from the location, surrounding neighborhood, and the potential highest and best use of the land, as they say.

Unfortunately, the tragic earthquake claimed over a dozen lives with many more injured. Those fortunate enough to avoid physical harm will still suffer serious financial consequences, despite the vast majority having some form of basic earthquake insurance. First, the authorities quickly ruled that owners of the Uranus Condo must continue paying the mortgages, despite the total destruction and uninhabitability of their real estate. In fact, during the 9/21 earthquake many years prior, banks were able to convert mortgage debts into personal debts for homeowners.

As a one-two punch, most insurance payouts would not exceed $50K USD, far less than a typical home, even in Hualien, Taiwan. The rationale? You guessed it, our theme today is the value is in the land, not the building! To estimate the coverage gap, we can check the Taiwan equivalent of the RealtyHop property record search to find recent purchases at the 天王星 building. Someone JUST purchased two months ago in February 2024, although as a $1.6M NTD studio, the loss of coverage should be minimal. Less fortunate is the buyer of the 3rd floor condo less than one year prior, who paid $2.7M NTD, possibly expecting a decently high cap rate and more appreciation on their investment. Cap rates on residential buildings in Hualian range from 4-5%. The $1.6M studio owner could have rented it out for about 9K a month, netting about 6K after non-financing expenses. Instead, these owners will need to continue paying their mortgages, not have a viable unit to use as a home or source of sublet income, AND the insurance payout is not enough to find an equivalent new place or even payoff the financing. Imagine if the earthquake had impacted a larger city such as Taipei — the losses from the insurance cap could be staggering (a $1.5M NTD payout on a similar studio in a 30-year old building might not even cover 10% of the replacement cost in the urban cities).

Tax Depreciation: Do Not Depreciate Land

There is a much more common and less morbid situation where the land, building, and real estate values cause some confusion: cost basis and tax depreciation. The IRS allows a landlord to depreciate residential real estate assuming a 27.5 year useful lifespan. That is, the day you buy a house intendnig to rent it out, whether the house is brand new or built 50 years ago, the timer starts on the 27.5 years. You are allowed to take a depreciation expense every year.

Say you decided to buy the house at 345 Northeast 163rd Street in Golden Glades, Miami, FL for the asking price of $780K, all cash (there is a 2.5% buyer agent fee, so assume your negotiation skills made that go away). The high cap rate attracts you, so you manage to sublet it for $4000 a month while paying $564 in real estate taxes and $436 in maintenance and management of various sorts (nice round numbers, $3K a month profit). You are making money and therefore owe income tax. However, thanks to the wonders of depreciation, you can reduce the tax and increase cashflow.

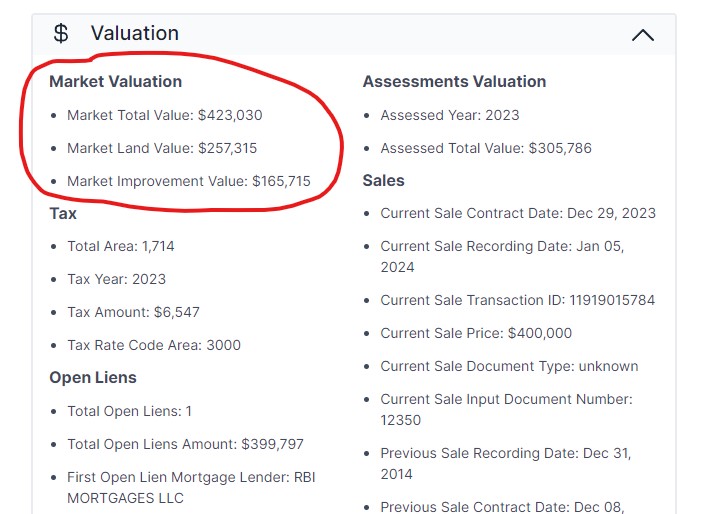

Can you simply take a straight-line depreciation and divide $780K by 27.5 to get an annual $28,363 deduction? Not so fast! The IRS won’t let you depreciate the entire purchase price of the home. Instead, they suggest pouring over assessor data to separate out the value of the land from that of the home. Let’s take a closer look at the RealtyHop data. Notice that the folks at the Miami-Dade County have conveniently broken down what they feel is the market value, how much is based on land, and how much is based on the “improvements” to the land (hint: the house sitting on the land is the improvement).

So What Am I Allowed to Depreciate?

After consulting with several experienced landlords, it seems everyone does things a little differently. Some people downright ignore this land issue and depreciate the entire $780K. However, that is almost certainly illegal. The proper approach is to try to tease out the value of the house itself, aka the improvements, by assigning some value to the land and the rest to the house. In our Golden Glades example above, the county assigned $257,315 of value to the land. Perhaps that means the remainder of the purchase price must be the house, a simple subtraction.

Yikes, but is that correct? Remember, these valuations are based on the most recent transaction of $400K a few years ago. Now the asking price is much higher — is it because the seller is a home flipper who put in tons of sweat equity, upgrades, and renovations to add $380K in value? Or do you need to equally scale the ratio of the land and house valuations? The IRS actually gives us some depreciation guidance for separating land and home, but it’s not for the faint of heart (emphasis added).

They proceed with an example:

Back to our Golden Glades home, the fair market value of our ratio seems to be $165,715/$423,030 = 39.2%. Meaning the cost basis we can depreciate for the house is only 39.2% of what we originally calculated above. Darn.

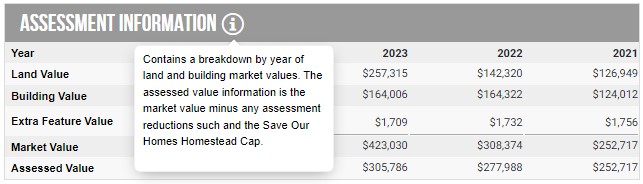

Things get a little more optimistic, or complicated, because Miami actually quotes a different number for assessed value and market value. Look up the address on their county assessor website and you will see the assessed value in 2023 is only $305,786, with no breakdown given between land and home. This is due to some local rule called the “Save Our Homes Homestead Cap“. We also see a wildly fluctuating ratio between home and land in their 2021-2023 data, meaning the IRS suggestion to use a constant FMV ratio based on your purchase date is somewhat dubious.

In the future, we may cover solutions to this problem, including itemizing improvements and putting renovations on their own separate depreciation schedules from the rest of the house. We can also look at various ways to interpret assessment cap situations such as the one in Florida and other state and local adjustments.

Mr. "Hud" Chavij recently came from abroad and brought with him a level of determination and creativity that instantly gained him a reputation among the NYC real estate thought leaders.