Inflation is here to stay, at least for a while, and policymakers are ready to act accordingly. Jerome H. Powell, who was recently renominated as Federal Reserve chair by the Biden Administration, acknowledged in his testimony to the Senate Banking Committee that rapidly increasing expenses on goods ranging from fuel to housing and food may not be transitory after all.

The US Central Bank will need to walk a tight rope keeping prices low in an economy still struggling with a disrupted supply chain, chronic workforce shortages, and the apparition of a new coronavirus variant. Here is what we can expect from Mr. Powell’s statement.

Managing inflation

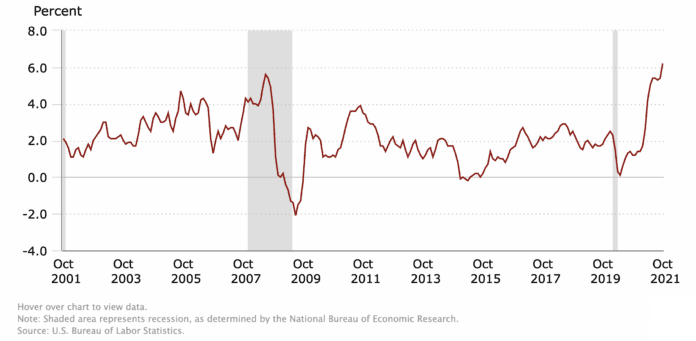

Until yesterday, authorities had maintained that the inflation affecting prices across the board, the highest it has been since the 1990s, was transitory, as the economy was catching up after its mishaps during the COVID-19 pandemic. However, the Central Bank is changing its tune and is gearing up to act accordingly.

Inflation is likely to remain high well into 2022. The Fed is considering tapering down on its bond purchase program sooner than expected to keep things in check. The central bank has purchased over $8 trillion of government-backed securities since early 2020 and was expected to maintain the pace until the economy reached its goal of stable 2% inflation and a healthy labor market.

“At this point, the economy is very strong, and inflationary pressures are high,” Powell reported. “It is therefore appropriate in my view to consider wrapping up the taper of our asset purchases, which we actually announced at our November meeting, perhaps a few months sooner.”

“Our decision today to begin tapering our asset purchases does not imply and direct signal regarding our interest rate policy,” Powell said. Nevertheless, this move still sets the stage for increased interest rates in the mid-term to keep inflation under control.

Nevertheless, while hiking the cost of borrowing could slow the demand, it could also lead to slow down hiring, which adds a pressure point in an economy still handicapped by the ever-present coronavirus.

The Omicron unknown

The Delta variant rapidly spread worldwide despite relatively high vaccination rates in many parts of the world, leading to new lockdowns and disruptions. Therefore, it is no surprise that the newly discovered Omicron puts economists on high alert.

The highly mutated virus was first identified in South Africa but is already making its way around the globe, including the United States. It could be resistant to the existing vaccines, be more contagious, and, therefore, have dire consequences on the economy. “Greater concerns about the virus could reduce people’s willingness to work in person, which would slow progress in the labor market and intensify supply-chain disruptions,” Powell said in his testimony.

The existing workforce shortage, combined with a new wave of workers to stay home for fear of contagion or to handle dependants’ care, could further disrupt the economic recovery. It would not bid well with aggressive monetary policies. “Price stability is one of our two goals, the other being maximum employment,” Powell said. “We have to balance those two goals when they’re in tension as they are right now. I assure you we will use our tools to make sure this high inflation we’re experiencing does not become entrenched.”

What’s next?

Hopefully, we will know more about the severity of the Omicron variant by the time of the next gathering of the policy-setting Federal Open Market Committee on December 14-15. So far, the Fed has taken no concrete measures to taper its bond purchase program, let alone raise the interest rates. Nearly twenty months into the pandemic, the coronavirus continues to affect our daily lives and keep policymakers on their toes.

Mortgage interests rates have been near historic lows since the beginning of the pandemic, thanks to emergency actions taken by the Federal Reserve. The low rates have driven up home prices across the nation. According to RealtyHop’s most recent Housing Affordability Index, the housing market remained competitive and expensive cities became even more unaffordable in November. With Powell and Yellen signaling faster tapering, interest rates are bound to increase as the situation normalizes – whether the threat of a new deadly variant materializes or not.

For would-be homebuyers and owners looking to refinance, acting sooner could mean saving money in the long run. However, if now is not the time, experts consider that, while interest rates will likely be higher in 2022, they should remain reasonable at or below 4%.

After graduating with a Master’s degree in marketing from Sciences Po Paris and a career as a real estate appraiser, Alix Barnaud renewed her lifelong passion for writing. She is a content writer and copywriter specializing in real estate and finds endless fascination in the connection between real estate, economic trends, and social changes. In her free time, she enjoys hiking, yoga, and traveling.