For many New Yorkers, homeownership feels like a step towards true independence. No landlord to comment on your pets or decor choices, control over what repairs are done and when, and a general sense of autonomy when it comes to your property.

But that’s where the NYC Tax Lien Sale: a lien sale on unpaid property-related charges can put your homeownership at risk.

However, just because it’s only your name on the deed does not mean you have to navigate the potential loss of your home alone, especially if you reside in the Brooklyn neighborhood of Bedford-Stuyvesant.

That’s where organizations like the Brownstoners of Bedford-Stuyvesant come into play —a not-for-profit, volunteer service organization dedicated to the continued preservation, revitalization, and enhancement of their community. Since 1978, this organization has been working to combat unresponsive public services, redlining, and prejudice against Bed-Stuy homeowners.

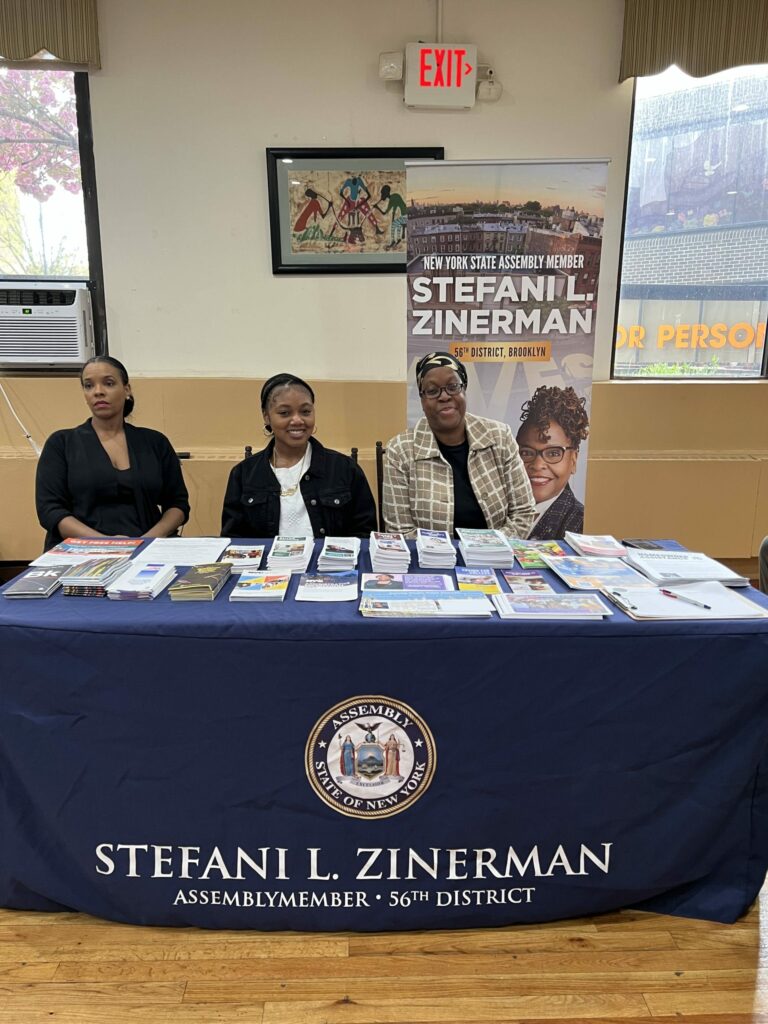

On April 22nd, in partnership with Council Member Chi Osse, Neighborhood Housing Services (NHS), and Bridge Street Development, the Brownstoners hosted a free tax lien resource workshop at the Bedford Stuyvesant Restoration Corporation. The goal of this event was to provide resources and information about the tax lien sale and foreclosure process, as well as the rights and responsibilities of homeowners.

There are currently more than a thousand properties in District 36 (Bedford-Stuyvesant and North Crown Heights) on the Tax Lien list, and about 40 attendees turned up to educate themselves on the process and resources available.

In attendance were also members of the Department of Environmental Protection, Department of Finance, The Brownstoners of Bedford Stuyvesant Inc, Bridge Street Development Corp, and Assemblymember Stefani Zimmerman.

In addition to this event, the Brownstoners have been committed to community support and helping homeowners stay in their homes. They have recently gone door-to-door to inform Bed-Stuy homeowners about the upcoming sale and provide them with resources.

What is New York City’s tax lien sale?

In 1996, Mayor Rudy Giuliani implemented tax lien sales to raise city revenue by collecting unpaid taxes and reducing the number of abandoned properties.

Lien sales occur when unpaid property taxes, water and sewer charges, and other property-related fees have not been paid. They are not open for purchase to anyone. These debts are sold to an authorized buyer, investors, who can then attempt to collect the debt, adding interest and fees, and can initiate foreclosure if the debt remains unpaid.

A hot-button political issue, groups such as the Abolish the NYC Tax Lien Sale Coalition are fighitng to eradicate the sale due to the way in the past it “negatively and disproportionately affected communities of color by allowing investors (and the already well-off) to benefit from the financial struggles of homeowners and small property owners in these communities.”

In fact, Mayor Adams included the tax lien sale in his mayoral campaign on ending these sales due to it being an unjust “or an effective debt collection program,” and criticised its impact on marginalized communities that target their generational wealth.

However, since that time, he has softened his stance, stating, “Nobody likes lien sales. As a property owner, I don’t want it as well. But you need tools to send a message for frequent violators of property tax, water bills. We are going to continue to communicate with the Council to see if we could put in place some form of lien sale that is fair because we don’t want to take property from New Yorkers based on taxes or water bills, but you do have to pay the costs of running the city.”

The last lien sale occurred in December 2021 and involved over 2,800 properties and generated $86.9 million for the city, despite excluding liens for water and sewer bills.

When is the next NYC Tax Lien Sale?

The next tax lien sale will occur on May 20th, 2025.

How do I know if my property is at risk of being sold at NYC’s Tax Lien Sale?

Homeowners at risk will have received warning notices 90, 60, 30, and 10 days before the sale. A list of properties that are eligible for the lien sale can be found on the NYC Department of Finance website. Property owners must take action by May 19, 2025.

What do I do if my property is on NYC’s Tax Lien Sale?

To avoid inclusion in the tax lien sale, homeowners have some of the following options:

- Pay the outstanding debt: Full payment of owed amounts.

- Enter into a payment plan: Options include standard plans and the Property Tax and Interest Deferral (PT AID) program, which may offer reduced interest rates.

- Apply for property tax exemptions, Such as the Senior Citizen Homeowners’ Exemption (SCHE) or the Disabled Homeowners’ Exemption (DHE)

- Submit a Lien Sale Easy Exit Program application: Eligible homeowners can be removed from the lien sale for one year

- Submit an emergency repair certification: Applicable if only HPD Emergency Repair charges are owed.

For more information on how to save your home, please contact the District 36 office at 718-919-0740.

Alda is a mom, Brooklynite, and real estate lover. In her free time, she cruises real estate listings to dream of a perfectly attainable several million-dollar brownstone, much to her husband's annoyance. Alda is also convinced she knows everything there is to know about New York City, based solely on consistent people-watching and eavesdropping. Mrs. Burrows would be an amazing trivia partner but instead chooses to write about all the random stuff she knows.